defer capital gains tax canada

In this instance the. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

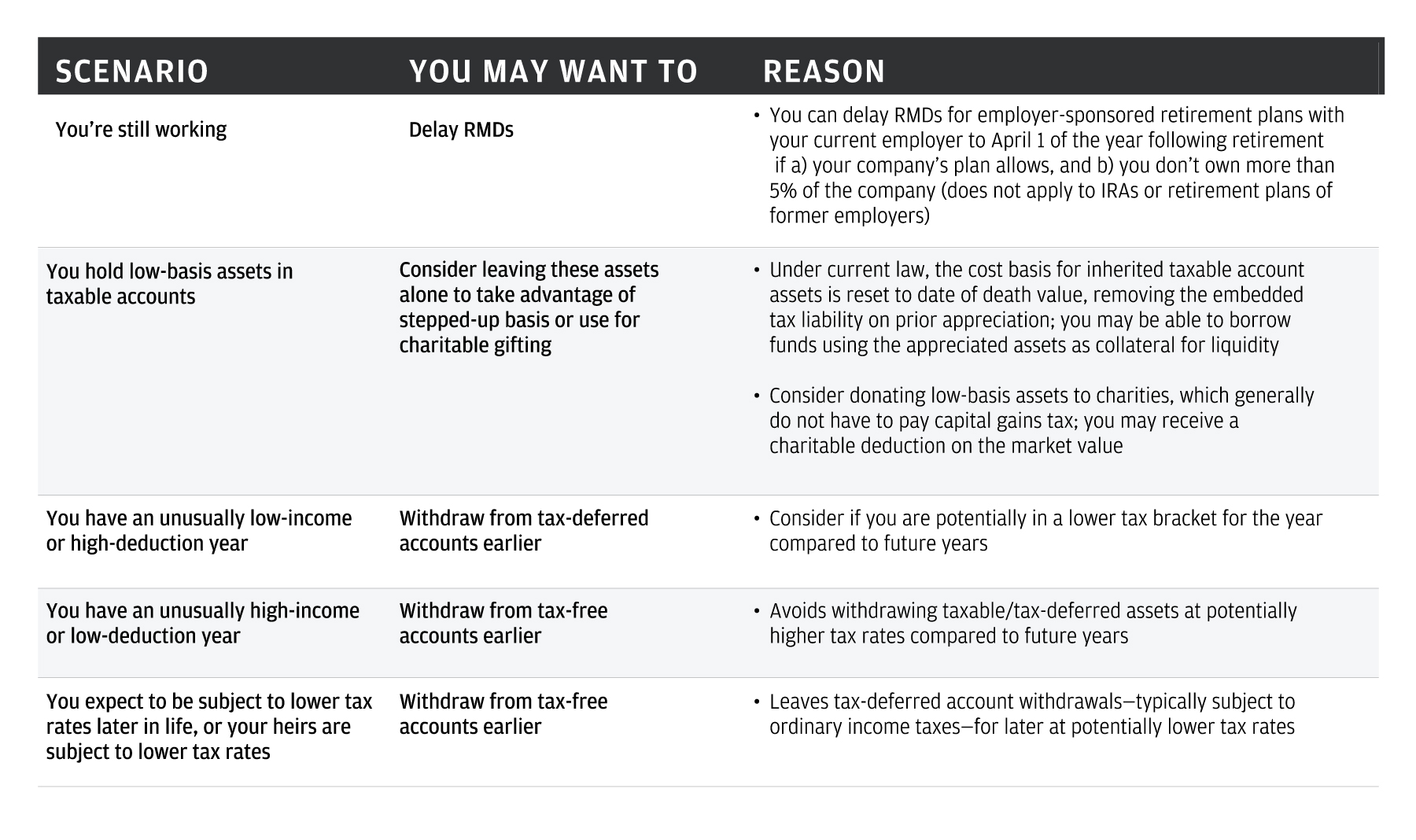

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

- Want To Learn More With Thomas.

. Your sale price 3950- your ACB 13002650. If the capital gain is 50000 this amount may push the taxpayer into the 25 percent marginal tax bracket. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021.

They have something called a 1031 Exchange that. Claiming this reserve will allow the deferral of. And the tax rate depends on your income.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax. Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Deferral election is not taken but can claim CCA. The inclusion rate has varied over time see graph below.

One of the cleanest ways to save yourself from capital gains tax in Canada is to defer your earnings. In this way you only owe taxes on the received earnings. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

January 1 2022 is the 50th anniversary of the capital gains tax. A Brief History of the Capital Gains Tax in Canada. The inclusion rate is the percentage of your gains that are subject to tax.

If you sell 1000 worth of ABC stock and 2000worth of XYZ stock in the same calendar year your net gain is 0 since the gains from. 1972 - it started with a 50 Inclusion Rate and all prior. For instance if you buy a property.

Since its more than your ACB you have a capital gain. As of 2022 it stands at 50. Youre right in the US.

You must pay taxes on 50 of this gain at your marginal tax rate. The first way to avoid paying capital gains tax on rental property in Canada is to defer the sale of your property to a later date. Tom Karadza Hi Aaron Thanks for your questions.

Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce. Deferral of Tax on Investment Properties by. This can be done using Section 1031 of the tax.

Balance out your capital losses. For a Canadian who falls in a 33 marginal. This deferral applies to dispositions where you use.

What would capital gains tax be on 50 000. To claim this reserve form T2017 in schedule 3 must be completed and submitted with your personal tax return for the year of sale. In Canada you only pay tax on 50 of any capital gains you realize.

When you sell a capital property for more than you paid for it this is called a capital gain. - Not sure If you are on the right path in saving Download this FREE Financial Clarity Checklist.

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

How To Avoid Canada S Capital Gains Tax Private Advisory Vancouver Bc

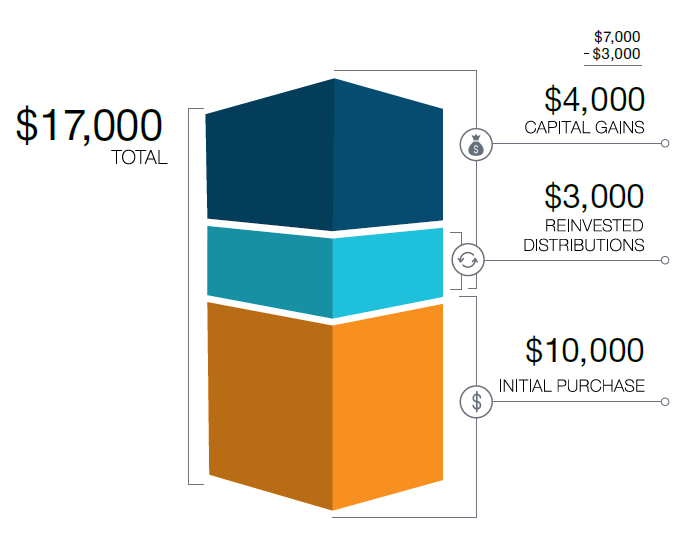

End Of Year Tax Considerations For Capital Gains Understanding Mutual Fund Distributions T Rowe Price

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Taxation For Capital Gains Capital Gains Reserve For Future Proceeds

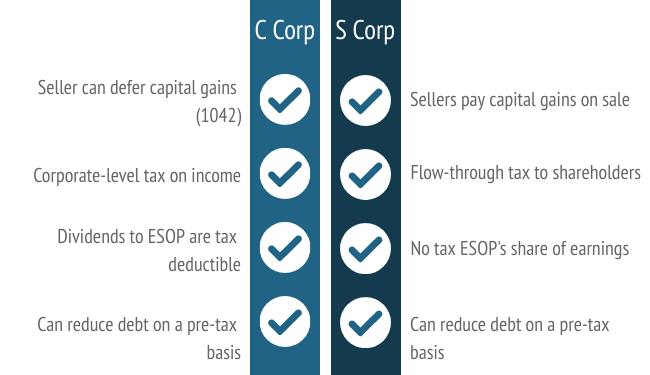

Esop Tax Incentives For Selling Shareholders

How Do I Report Capital Gains In British Columbia

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Using Replacement Property To Defer Capital Gains On Farmland Baker Tilly Canada Chartered Professional Accountants

How To Defer Capital Gains Tax On Real Estate Sales Madan Ca

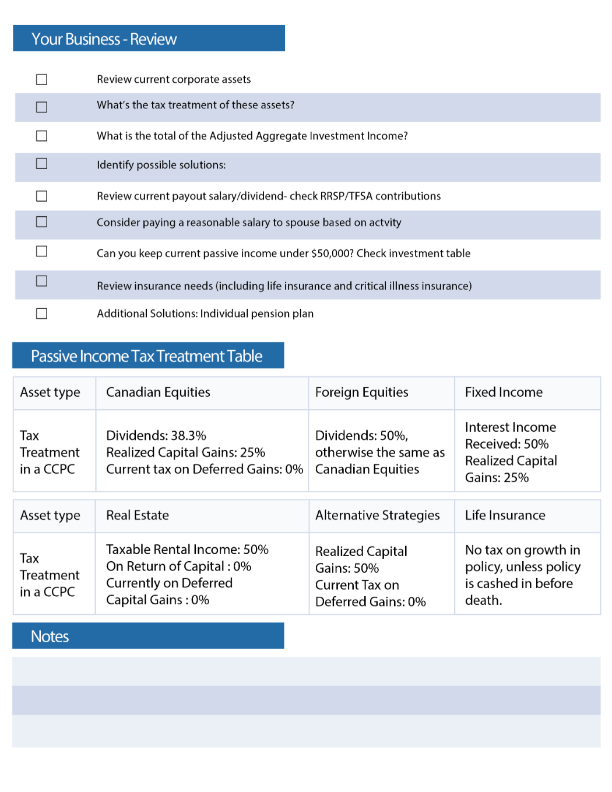

Determine Your Passive Investment Income Limit Free Tools

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Capital Gains Tax In The United States Wikipedia

Defer Capital Gains Tax When To Pay Taxes Manning Elliott

Tax Break For Trump Nominees From Goldman Sachs Is A Deferral Not A Permanent Windfall Marketwatch